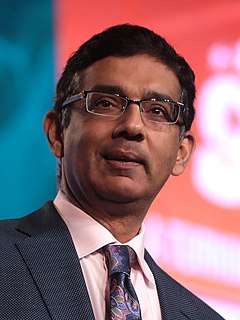

A Quote by Dinesh D'Souza

Well, the taxes that everyone else is paying are supporting lots of programs that were in place prior to Obama's new spending. So new spending has too be paid for by new taxes, or by eliminating existing tax breaks. And Obama wants that burden to be borne exclusively by the rich.

Related Quotes

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

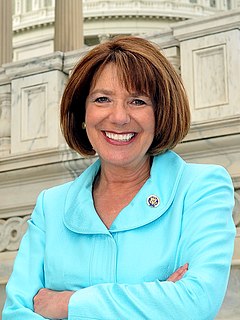

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

Well, you have the public not wanting any new spending, you have the Republicans not wanting any new taxes, you have the Democrats not wanting any new spending cuts, you have the markets not wanting any new borrowing, and you have the economists wanting all of the above. And that leads to paralysis.

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

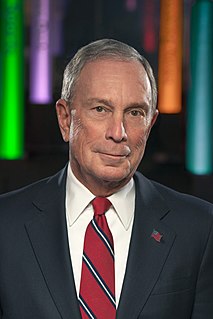

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.