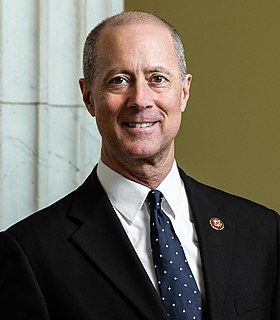

A Quote by Doc Hastings

With my support, the House of Representatives recently voted to permanently repeal the death tax so that family farms and businesses can be passed down to children and grandchildren.

Related Quotes

Threats of trade protectionism, plus unilateral actions on the exchange-rate front, such as the heavy interventions of China, Japan, and Switzerland in the currency markets - not to mention the retaliatory tariffs recently passed by the U.S. House of Representatives - endanger growth prospects and could further depress financial market confidence.