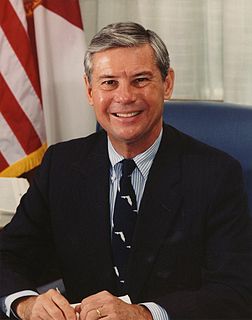

A Quote by Doc Hastings

Unfortunately, actions taken by the Senate ensured that relief from the death tax would only be temporary and that it would come back to life at the full rate again in 2011.

Related Quotes

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

I yearn for the darkness. I pray for death. Real death. If I thought that in death I would meet the people I've known in life I don't know what I'd do. That would be the ultimate horror. The ultimate despair. If I had to meet my mother again and start all of that all over, only this time without the prospect of death to look forward to? Well. That would be the final nightmare. Kafka on wheels.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

If I had my life over again I should form the habit of nightly composing myself to thoughts of death. I would practise, as it were, the remembrance of death. There is no other practice which so intensifies life. Death, when it approaches, ought not to take one by surprise. It should be part of the full expectancy of life. Without an ever-present sense of death life is insipid.

What if it is for life's sake that we must die? In truth we are not individuals; and it is because we think ourselves such that death seems unforgivable. We are temporary organs of the race, cells in the body of life; we die and drop away that life may remain young and strong. If we were to live forever, growth would be stifled, and youth would find no room on earth. Death, like style, is the removal of rubbish, the circumcision of the superfluous. In the midst of death life renews itself immortally.

I had nothing to do with death panels. I thought it was a horrible phrase about end of life. I didn't think it was accurate, and I was - I've always been opposed to it. The reason why I stood behind that phrase "death tax" for so many years is because the only time that you could pay that tax, the only time, is on the death of a relative. And that's what makes it a death tax. You have to be accurate.