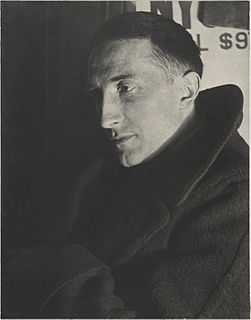

A Quote by Donald Sultan

I don't think anybody ever makes any money buying and selling stock. They have to make money by keeping the stock.

Related Quotes

We are seeing a lot of cases where the startups are writing the term sheet, dictating the terms, selling common stock instead of preferred stock, where they don't give the investor veto rights or board seat or privileges, and they are really asking the investor -- why should I take your money when there is other money available.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

Look, rich people already have a lot of money. There's literally trillions of dollars in cash held by corporations, their stock valuations at an all-time high. They do not need a tax cut to do anything. They can invest now, if they wanted to. They don't want to, because they can make more money just by mergers and stock buybacks and stuff like that. So, this is really just sort of a travesty.

I always had faith in the internet. I believed in it and thought it was obviously going to change the way the world worked. I really did not understand why others were selling their stock. As stock prices plunged, I just bought them, one after another, since I had the money. I guess I was rather lucky.

When I say the economy is shrinking, it's the economy of the 99%, the people who have to work for a living and depend on earning money for what they can spend. The 1% makes its money basically by lending out their money to the 99%, on charging interest and speculating. So the stock market's doubled, the bond market's gone way up, and the 1% are earning more money than ever before, but the 99% are not. They're having to pay the 1%.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Is money money or isn't money money. Everybody who earns

it and spends it every day in order to live knows

that money is money, anybody who votes it to be

gathered in as taxes knows money is not money. That

is what makes everybody go crazy.... When you earn

money and spend money every day anybody can know the

difference between a million and three. But when you

vote money away there really is not any difference

between a million and three.