A Quote by Donald Trump

There will be a major border tax on these companies that are leaving and getting away with murder. And if our politicians had what it takes, they would have done this years ago. And you'd have millions more workers right now in the United States that are - 96 million really wanting a job and they can't get.

Related Quotes

The basic thing that made Trump popular is that he blamed others for the problems that we have in the United States. We have a problem. Let's face it. The typical income, median income, of a full-time male worker - and the workers who have a full-time job are the lucky ones - is at the same level it was 42 years ago. At the bottom, real wages in the United States are at the same level they were 60 years ago.

We agree with that goal [to secure our border] and will be working with [Donald Trump] to finance on construction of the physical barrier, including the wall on the southern border. The law is already on the books. I voted for it, like, ten years ago, but nothing has gotten done and now we have a president who actually wants to secure the border and we are all in favor of doing that.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

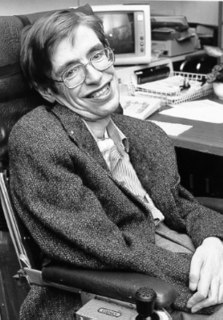

Think of our DNA. In the last million years, our DNA hasn't changed at all. It's really much the same as it was in the jungle, a million, two millions years ago. But in the last 200 years, our destructive capacities have increased many, many millions of times over. Why don't we see intelligent signals from outer space? Because in all likelihood, once the civilization reaches the point our civilization has reached, it destroys itself.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

Now all of the ideas that I'm talking about, they are not radical ideas. Making public colleges and universities tuition free, that exists in countries all over the world, used to exist in the United States. Rebuilding our crumbling infrastructure, and creating 13 million jobs by doing away with tax loopholes that large corporations now enjoy by putting their money into the Cayman Islands and other tax havens. That is not a radical idea.

While writing my memoir, 'When Skateboards Will Be Free,' I would sometimes have to pore over hours of microfilm at the New York Public Library in order to try to get one obscure detail right. For instance, was the Socialist Workers Party originally called the American Workers Party or the Workers Party of the United States?

We have an obligation to each other to not only push our politicians, but to push companies to do right by their workers. They wouldn't even have successful companies without their workers. They are the glue that keeps things together. How, in the 21st century, we have mega-corporations that have lost sight of that boggles my mind.