A Quote by Donald Trump

When a company wants to move to Mexico or another company - or another country and they want to build a nice, beautiful factory and they want to sell their product through our border, no tax, and the people that all got fired, so we end up with unemployment and debt, and they end up with jobs and factories and all of the other things, not going to happen that way. And the way you stop it is by imposing a tax.

Related Quotes

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

[In Mexico] they have a VAT tax. We're on a different system. When we sell into Mexico, there's a tax. When they sell in - automatic, 16 percent, approximately. When they sell into us, there's no tax. It's a defective agreement. It's been defective for a long time, many years, but the politicians haven't done anything about it.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

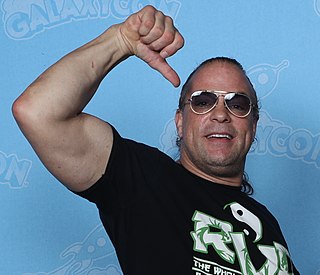

You can't patent a move. It's challenging enough to come up with a move that nobody else does... I try and do things that I would want to see done that I haven't seen other people do. Most wrestlers obviously don't think that way, and instead they steal somebody's move as soon as they've gone on to the next company.

I have my own theory about why decline happens at companies like IBM or Microsoft. The company does a great job, innovates and becomes a monopoly or close to it in some field, and then the quality of the product becomes less important. The company starts valuing the great salesmen, because they’re the ones who can move the needle on revenues, not the product engineers and designers. So the salespeople end up running the company.

The reality is the only place a company's culture is going to start and end is at the beginning of that company. And it always starts with the founders. So if you can't create an environment of founders and founding employees who are going to represent the company you want, then you are never going to get there. You have to look at your own network and find what you are missing. So if you don't have a female or someone who has an international perspective or a person with a bio degree, but those perspectives matter to the firm or product you want to create, then it's never going to work out.

You make other team think you going one way and you got to sell the move going that way and you've got to really make them think that you're going that way and they're going the other way. When it ends up ultimately being a perfect crossover is when you shake them so bad that they can't even get back into the play to play defense. You're already gone. That's what I think the perfect one is to where a teammate of his has to stop you from scoring.