A Quote by Donald Verrilli Jr.

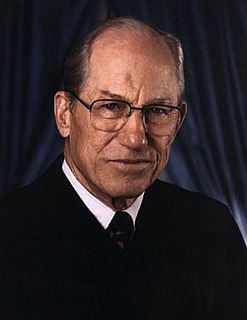

I don't think this is a situation where you can say that Congress was avoiding any mention of the tax power. It'd be one thing if Congress explicitly disavowed an exercise of the tax power. But given that it hasn't done so, it seems to me that it's - not only is it fair to read this as an exercise of the tax power, but this court has got an obligation to construe it as an exercise of the tax power if it can be upheld on that basis.

Related Quotes

Justice [Sonia]Sotomayor said, "Let's talk - you want to talk about the tax power."And I got like a 10-minute run on the tax power. And, boy, was I glad I did because I was able to get across this idea that, yes, this is a narrower ground on which you can affirm it. And I think everybody agrees. I think even the dissenting justices ultimately in the case agreed that, if Congress had expressly called it a tax, it would be indisputably constitutional.

John Marshall's warning that the power to tax is the power to destroy has taken on far greater meaning... more specifically, the power of the Internal Revenue Service is threatening to destroy the freedom of religion , guaranteed by the First Amendment. As part of that guarantee, Congress has granted tax exemptions for churches to avoid excessive interference in their religious activities.

The President can exercise no power which cannot be fairly and reasonably traced to some specific grant of power in the Federal Constitution or in an act of Congress passed in pursuance thereof. There is no undefined residuum of power which he can exercise because it seems to him to be in the public interest.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

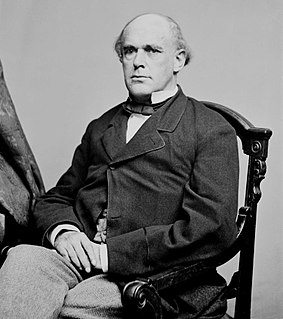

If Congress sees fit to impose a capitation, or other direct tax, it must be laid in proportion to the census; if Congress determines to impose duties, imposts, and excises, they must be uniform throughout the United States. These are not strictly limitations of power. They are rules prescribing the mode in which it shall be exercised... This review shows that personal property, contracts, occupations, and the like have never been regarded by Congress as proper subjects of direct tax.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.