A Quote by Doug Casey

Government intervention in the economy - through taxes, regulation and, most importantly, currency inflation - causes distortions and misallocations of capital that must eventually be unwound. The distortions degrade the general standard of living, and the economy goes into a recession (call that an incomplete cleansing). Or it goes into a depression - wherein the entire sickly structure comes unglued.

Related Quotes

Vanity, fear, desire, competition - all such distortions within our own egos - condition our vision of those in relation to us. Add to those distortions to our own egos the corresponding distortions in the egos of others, and you see how cloudy the glass must become through which we look at each other.

The most sinister of all taxes is the inflation tax and it is the most regressive. It hits the poor and the middle class. When you destroy a currency by creating money out of thin air to pay the bills, the value of the dollar goes down, and people get hit with a higher cost of living. It's the middle class that's being wiped out. It is most evil of all taxes.

In general, presidents and congressmen have very limited power to do good for the economy and awesome power to do bad. The best good thing that politicians can do for the economy is to stop doing bad. In part, this can be achieved through reducing taxes and economic regulation, and staying out of our lives.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.

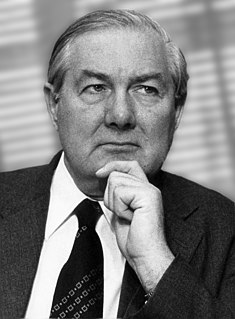

We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step.

There are winners and there are losers. And as much as we would like to help the losers, if we do it in the way that directs the limited capital of the society to support the low-productivity parts of the economy, it means that the rest of the economy - our overall standard of living - will not rise as much as it could.