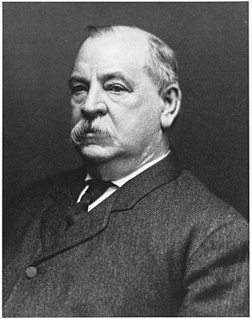

A Quote by Doug Casey

People who buy government debt deserve to be punished and taught a lesson

Quote Topics

Related Quotes

Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money. I borrowed money for a car only because I knew it could increase my income. Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.

Any politician that says no tax revenue or zero spending cuts does not deserve reelection. Our hole is so deep in this country with the debt and the debt service, the interest on that debt, before the big expenses come for Social Security and Medicare - for we baby boomers in a few years - that everything has to be on the table.

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.