A Quote by Douglas Leone

We see China as a large market opportunity with similar cyclical economic cycles that occur throughout every economy.

Related Quotes

I believe in market economics. But to paraphrase Churchill - who said this about democracy and political regimes - a market economy might be the worst economic regime available, apart from the alternatives. I believe that people react to incentives, that incentives matter, and that prices reflect the way things should be allocated. But I also believe that market economies sometimes have market failures, and when these occur, there's a role for prudential - not excessive - regulation of the financial system.

China has seen a great deal of economic progress. It's certainly rather of a miracle. The growing role of the market in the economy will force China to open up its political system over time and to move toward a more democratic society. So taken as a whole, the one real failure in this whole business has been Russia.

You cannot just depend on the market, because the market will say: China needs oil; China needs coal; China needs whatever, and Africa has got all these things in abundance. And we go there and get them, and the more we develop the Chinese economy, the larger the manufacturing is, the more we need global markets - sell it to the Africans which indeed might very well destroy whatever infant industries are trying to develop on the continent. That is what the market would do.

In pursuing economic growth, India and the United States share similar values and similar challenges. We understand that the global economy is here to stay. To keep growing and leading the world in innovation and opportunity, the United States and India must trade freely, openly, and according to the principles of the global marketplace.

They'll [China] probably be a fully developed nation. The road there just is not going to be that easy. You're going from a macromanaged, top-down economy to a market-managed, micromanaged type of economy, with all the potential corruption issues, SOE [state-owned enterprise] reform, and market reform that come with it.

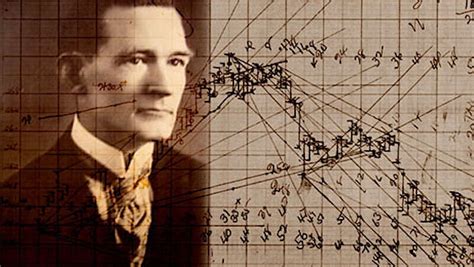

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

During the 1999 debate over Permanent Normal Trade Relations with China President Bill Clinton said, 'In opening the economy of China, the agreement will create unprecedented opportunities for American farmers, workers and companies to compete successfully in China's market. WRONG: Our trade deficit with China has increased from $83 billion in 2001 to a record breaking $342 billion in 2014.

The lack of opportunity is ever the excuse of a weak, vacillating mind. Opportunities! Every life is full of them. Every newspaper article is an opportunity. Every client is an opportunity. Every sermon is an opportunity. Every business transaction is an opportunity, an opportunity to be polite, an opportunity to be manly, an opportunity to be honest, an opportunity to make friends.