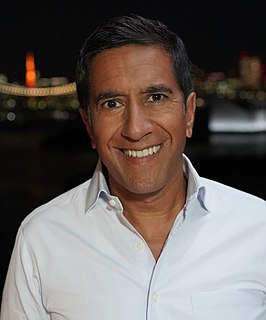

A Quote by Douglas Leone

During dark times, real entrepreneurs come out. They are not competing with 10 look-alike companies for engineering talent, so it's a great time to invest and help build companies.

Quote Topics

Related Quotes

I think that we can all learn from what smart companies are doing. My objective is to demonstrate what's possible, even during tough economic times. This is a period of great business dislocation, but that means it's also the time to try new things. This will be a challenge for existing companies. But the behaviors of smart companies can be learned.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.