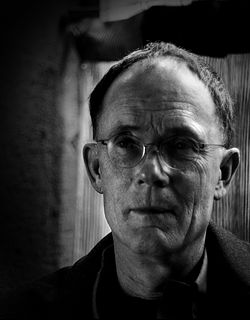

A Quote by Ed Seykota

My style is basically trend following, with some special pattern recognition and money management algorithms.

Related Quotes

We [at Soros Fund Management] use options and more exotic derivatives sparingly. We try to catch new trends early and in later stages we try to catch trend reversals. Therefore, we tend to stabilize rather than destabilize the market. We are not doing this as a public service. It is our style of making money.

There's increasing consciousness that a "command and control" style of management which one associates with a male model isn't necessarily what works anymore, especially with small to medium sized companies. There's increasing evidence that a more flexible management style, where responsibility is distributed up and down the line, is what works best. And that kind of management style is one that will allow individual workers more flexibility - men and women.

The ways in which management can express appreciation for an employee's contribution are without end; the key is to act in ways that communicate Thanks! That was a great job! We can really count on you! It's great having you here! While some people love having plaques to hang on their personal Wall of Fame and they adore being acknowledged at a formal Recognition Banquet and some people are only interested in money, I find the most effective forms of recognition are personal and either spontaneous or very close in time to a significant accomplishment.

Good money management alone isn't going to increase your edge at all. If your system isn't any good, you're still going to lose money, no matter how effective your money management rules are. But if you have an approach that makes money, then money management can make the difference between success and failure.

It's difficult to make your clients understand that there are certain days that the market will go up or down 2%, and it's basically driven by algorithms talking to algorithms. There's no real rhyme or reason for that. So it's difficult. We just try to preach long-term investing and staying the course.

Why, just a couple of economic seasons ago, was idle cash considered an indication of bad management or lazy management? Because it meant that management didn't have this money out at work ... Now look. Presto! A new fashion! Cash is back in! Denigrating liquidity has dropped quicker than hemlines. A management is now saluted if it has some cash, some liquidity, doesn't have to go to the money market at huge interest rates to get the wherewithal to keep going and growing. Along with Ben Franklin, my father and your father would understand and applaud this new economic fashion.