A Quote by Edmund Phelps

Narrow banks could restart effective intermediation and ensure that consumers and employment-creating small and medium-size enterprises are adequately financed and can contribute to the reactivation of the economy.

Quote Topics

Related Quotes

In Globalization 1.0, which began around 1492, the world went from size large to size medium. In Globalization 2.0, the era that introduced us to multinational companies, it went from size medium to size small. And then around 2000 came Globalization 3.0, in which the world went from being small to tiny.

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

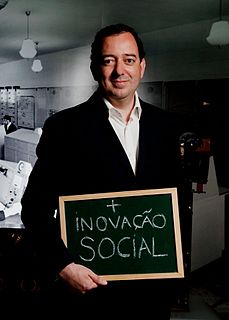

In the eighties and nineties, the innovation agenda was exclusively focused on enterprises. There was a time in which economic and social issues were seen as separate. Economy was producing wealth, society was spending. In the 21st century economy, this is not true anymore. Sectors like health, social services and education have a tendency to grow, in GDP percentage as well as in creating employment, whereas other industries are decreasing. In the long term, an innovation in social services or education will be as important as an innovation in the pharmaceutical or aerospatial industry.

Candidly, when you go back to '07 or '08, it was hard to sell cloud. We started out by focusing on large enterprises on day one. Everybody thought cloud was for SMBs (small and mid-size businesses), but we made the leap that it was going to be for large enterprises, that they were going to replace their core systems.

I'm not interested in, you know, turning the clock back or pointing fingers, but I am interested in trying to figure out how we come together to chart a better way forward and one that will restore confidence in, you know, small and medium-size businesses and consumers and begin to chip away at the unemployment rate.