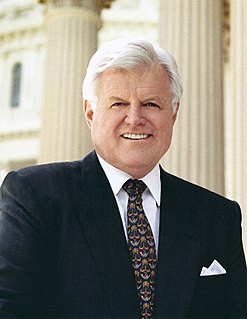

A Quote by Edward Kennedy

The tax system is stacked against the average taxpayer.

Related Quotes

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Taxing Women is a must-have primer for any woman who wants to understand how our current tax system affects her family's economic condition. In plain English, McCaffery explains how the tax code stacks the deck against women and why it's in women's economic interest to lead the next great tax rebellion.

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.