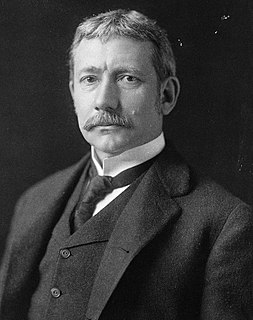

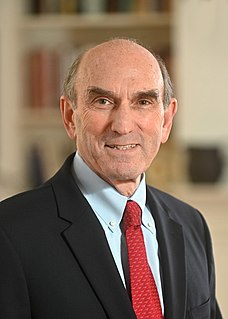

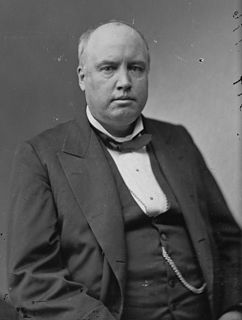

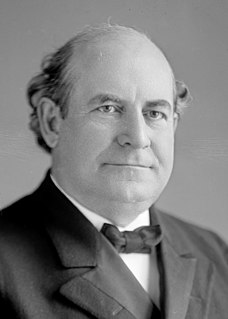

A Quote by Elihu Root

I guess you will have to go to jail. If that is the result of not understanding the Income Tax Law, I will meet you there. We shall have a merry, merry time, for all our friends will be there. It will be an intellectual center, for no one understands the Income Tax Law except persons who have not sufficient intelligence to understand the questions that arise under it.

Related Quotes

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

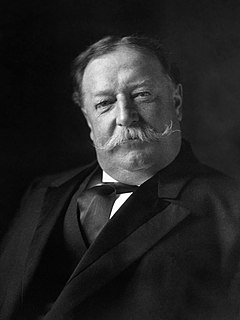

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

The best thing we can do for family values is to repeal the income tax. Then families will have the resources they need to implement their own values - and not those of the politicians. With the income tax gone, families will no longer be forced to have two breadwinners by necessity. Children will be raised better, family values will predominate, and crime will diminish. If your local school indoctrinates your child with values that are alien to you, you'll have the money to buy a private education.

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

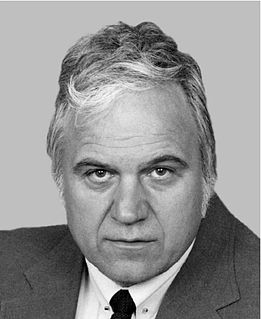

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

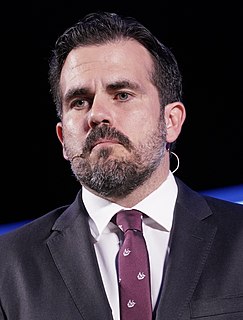

We're trying our best to develop sort of strategies. We have already turned into law a labor reform law that will allow for more opportunities to ensue. We have also established a permits law that will facilitate permits in Puerto Rico. We are about to roll out a comprehensive tax reform that will enhance the base and will reduce the rates in Puerto Rico.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.