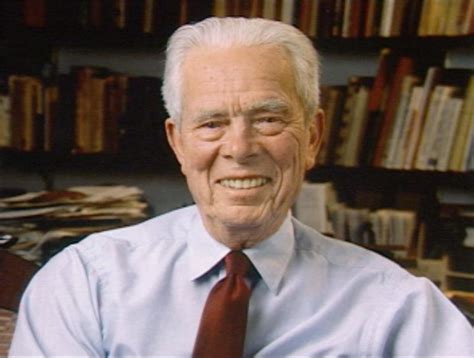

A Quote by Eliyahu Goldratt

Almost all decisions based on cost accounting are utterly wrong.

Quote Topics

Related Quotes

In their zeal for particular kinds of decisions to be made, those with the vision of the anointed seldom consider the nature of the: process: by which decisions are made. Often what they propose amounts to third-party decision making by people who pay no cost for being wrong-surely one of the least promising ways of reaching decisions satisfactory to those who must live with the consequences.

But to procrastinate and prevaricate simply because you're afraid of erring, when others - I mean our brethren in Germany - must make infinitely more difficult decisions every day, seems to me almost to run counter to love. To delay or fail to make decisions may be more sinful than to make wrong decisions out of faith and love.

Indecision is debilitating; it feeds upon itself; it is, one might almost say, habit-forming. Not only that, but it is contagious; it transmits itself to others. . . . Business is dependent upon action. It cannot go forward by hesitation. Those in executive positions must fortify themselves with facts and accept responsibility for decisions based upon them. Often greater risk is involved in postponement than in making a wrong decision.

The great myth is the manager as orchestra conductor. It's this idea of standing on a pedestal and you wave your baton and accounting comes in, and you wave it somewhere else and marketing chimes in with accounting, and they all sound very glorious. But management is more like orchestra conducting during rehearsals, when everything is going wrong.

Creative accounting is an absolute curse to a civilization. One could argue that double-entry bookkeeping was one of history's great advances. Using accounting for fraud and folly is a disgrace. In a democracy, it often takes a scandal to trigger reform. Enron was the most obvious example of a business culture gone wrong in a long, long time.

You have to understand accounting and you have to understand the nuances of accounting. It's the language of business and it's an imperfect language, but unless you are willing to put in the effort to learn accounting - how to read and interpret financial statements - you really shouldn't select stocks yourself

If you sat with a pencil and jotted down all the decisions you've taken in the past week, or, if you could, over your lifetime, you would realize that almost all of them have had asymmetric payoff, with one side carrying a larger consequence than the other. You decide principally based on fragility, not probability. Or to rephrase, You decide principally based on fragility, not so much on True/False.