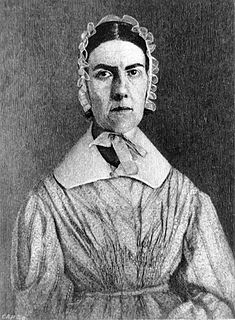

A Quote by Elizabeth Cady Stanton

If all those magnificent cathedrals with their valuable lands in Boston, Philadelphia and New York were taxed as they should be, the taxes of women who hold property would be proportionately lightened....I cannot see any good reason why wealthy churches and a certain amount of property of the clergy should be exempt from taxation, while every poor widow in the land, struggling to feed, clothe, and educate a family of children, must be taxed on the narrow lot and humble home.

Quote Topics

Amount

Any

Boston

Cannot

Cathedrals

Certain

Children

Churches

Clergy

Educate

Every

Exempt

Family

Feed

Good

Good Reason

Hold

Home

Humble

Land

Lands

Lot

Magnificent

Must

Narrow

New

New York

Philadelphia

Poor

Property

Reason

Reason Why

See

Should

Struggling

Taxation

Taxes

Those

Valuable

Wealthy

Were

While

Why

Widow

Women

Would

Would Be

York

Related Quotes

Legislators cannot invent too many devices for subdividing property... Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise. Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

The divorce between Church and State ought to be absolute. It ought to be so absolute that no Church property anywhere, in any state or in the nation, should be exempt from equal taxation; for if you exempt the property of any church organization, to that extent you impose a tax upon the whole community.

The earth, in its natural, uncultivated state was, and ever would have continued to be, the common property of the human race." As the land gets cultivated, "it is the value of the improvement, only, and not the earth itself, that is in individual property. Every proprietor, therefore, of cultivated lands, owes to the community a ground-rent..to every person, rich or poor...because it is in lieu of the natural inheritance, which, as a right, belongs to every man, over and above the property he may have created, or inherited from those who did

The churches rose to power on the income from tax-free property. What earthly -or heavenly- right have they got to enjoy a privilege denied to everyone else, even including nonprofit organizations? None! My contention is that with the churches exempted from property taxation, you and I have to pay that much more in taxes to make up for what they're not contributing.

'Green' cannot be allowed to become an excuse for stealth taxes. And nor should 'green taxes' be about punishment. Instead, they should represent a switch of emphasis. So if domestic flights are taxed, it should be on the absolute condition that the money is ploughed into improving the alternatives, such as trains.

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

On a nationwide basis, I would guess that the various churches would have to pay annually an amount at least equal to the national debt. But it's impossible for me to make an exact estimate, because the churches hide their wealth in every way they can - deliberate falsification as to the value of property, registering it under phony names in order to obscure the fact that the Church owns the property.

Suppose a nation, rich and poor, high and low, ten millions in number, all assembled together; not more than one or two millions will have lands, houses, or any personal property; if we take into the account the women and children, or even if we leave them out of the question, a great majority of every nation is wholly destitute of property, except a small quantity of clothes, and a few trifles of other movables.