A Quote by Elizabeth Warren

The bankers might not have said it in so many words, but gradually their strategy emerged: Target families who were already in a little trouble, lend them more money, get them entangled in high fees and astronomical interest rates, and then block the doors to the bankruptcy exit if they really got in over their heads.

Related Quotes

We live in a global market and money's fungible and hedge fund private equity is looking for momentum plays, and there ain't no momentum plays in bonds, right? When the interest rates were spiking up or down, well they never really spike down they do spike up though. Something's got to happen, there's got to be motion, the dice has to be rolling on the board, and if it's not then they're not going to play because they're not going to get the adrenaline rush from looking at... you know, money markets fund interest rates or bond interests or whatever. It's got to be sexy.

I was a high school student like Picasso. I was a little eccentric, but I had high ideals. I wanted to get along well with girl, but when I met them face-to-face, I acted cold toward them. I was always in the art room drawing, I wanted to attract someone's interest. I thought that if I got good at drawing I might be able to establish a connection with the world.

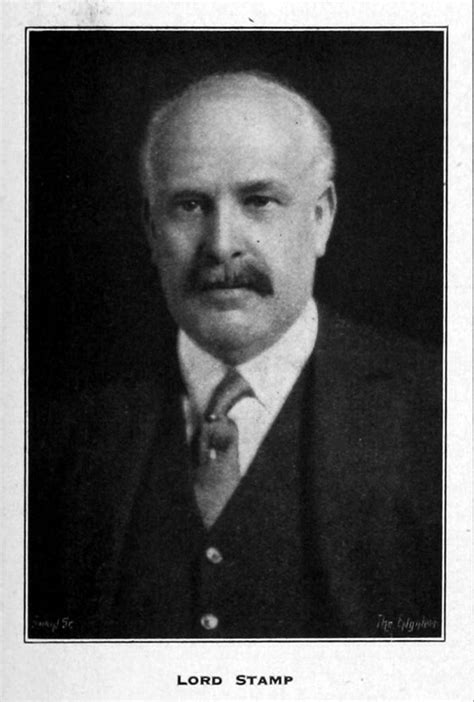

Banking was conceived in iniquity and born in sin... Bankers own the Earth. Take it away from them but leave them the power to create money, and, with the flick of a pen, they will create enough money to buy it back again... Take this great power away from them and all the great fortunes like mine will disappear and they ought to disappear, for then this would be a better and happier world to live in... But, if you want to continue to be a slave of the bankers and pay the cost of your own slavery, then let the bankers continue to create money and control credit.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

We spend our way to the poorhouse. We buy giant TVs and iPads. Our children wear nice clothes thanks to high-interest credit cards and payday loans. We purchase homes we don't need, refinance them for more spending money, and declare bankruptcy, often leaving them full of garbage in our wake. Thrift is inimical to our being.

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

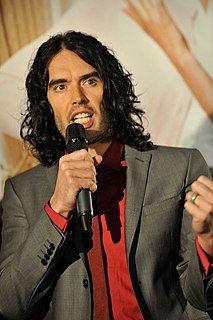

I really, really love children and I think probably among children is when I feel mostly berated. It's not like I feel like oh, there's some children here. I have to tone it down. I go nuts with children especially when I ain't got none. So when I'm round my mates' children, I jest them kids up first. I swear at them, I get more worked up, I say crazy stuff to them, fill their heads with nonsense and then I leave them.