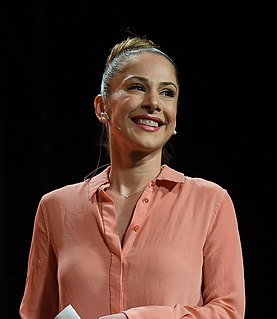

A Quote by Elizabeth Warren

Rising student-loan debt is an economic emergency.

Related Quotes

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Student debt is structured to be a burden for life. The indebted cannot declare bankruptcy, unlike Donald Trump. Current student debt is estimated to be over $1.45 trillion. There are ample resources for that simply from waste, including the bloated military and the enormous concentrated private wealth that has accumulated in the financial and general corporate sector under neoliberal policies. There is no economic reason why free education cannot flourish from schools through colleges and university. The barriers are not economic but rather political decisions.