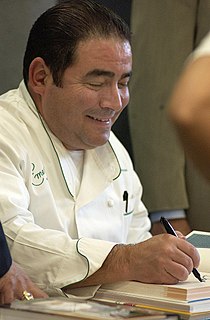

A Quote by Emeril Lagasse

We'll be going to the fish market and a farmer's market this afternoon to get what we need to make and eat dinner as a family. I'm trying to expose my kids to going to a farmers market or the fish market and learning what that's all about.

Related Quotes

When I get hurt in the market, I get the hell out. It doesn't matter at all where the market is trading. I just get out, because I believe that once you're hurt in the market, your decisions are going to be far less objective than they are when you're doing well If you stick around when the market is severely against you, sooner or later they are going to carry you out.

The Middle East would always be an important trading partner in just a market sense, like America is a big market for us, Asia is a big market, Europe is a big market. You are going to have hundreds of millions of consumers there, from just a standard market point of view, from a very narrow American point of view.

An old market had stood there until I'd been about six years old, when the authorities had renamed it the Olde Market, destroyed it, and built a new market devoted to selling T-shirts and other objects with pictures of the old market. Meanwhile, the people who had operated the little stalls in the old market had gone elsewhere and set up a thing on the edge of town that was now called the New Market even though it was actually the old market.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.