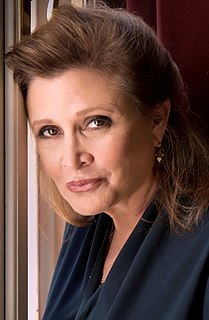

A Quote by Emily Mortimer

I was determined not to become an American citizen but I did it for completely cynical reasons: to avoid paying inheritance tax in the U.S.

Related Quotes

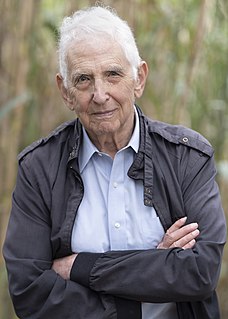

Why did I become a Canadian citizen? Not because I was rejecting being a U.S. citizen. At the time when I became a Canadian citizen, you couldn't be a dual citizen. Now you can. So I had to be one or the other. But the reason I became a Canadian citizen was because it simply seemed so abnormal to me not to be able to vote.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.