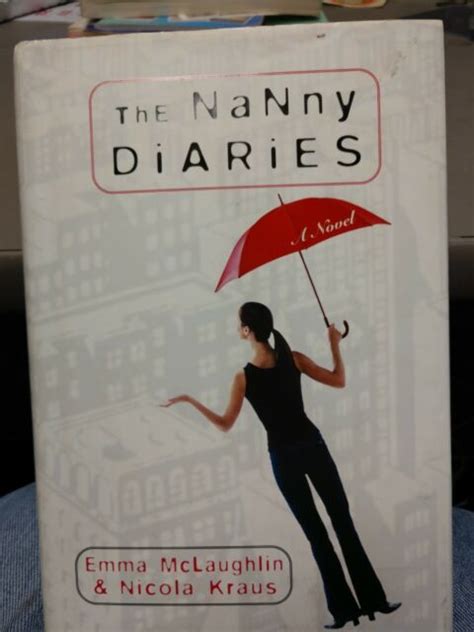

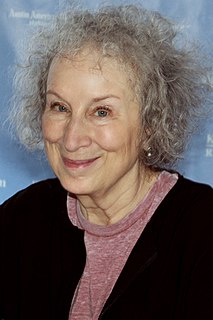

A Quote by Emma McLaughlin

Why can't everything be as easy as walking into H&M and putting a week's worth of clothes on a credit card?

Related Quotes

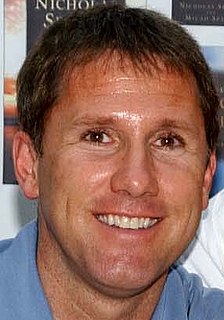

Once the settlement is completed, the credit card company will report it to the credit bureaus, which will then make a notation on your credit report that that account was paid by settlement. That's going to signal to future lenders that you left the last guy hanging. That's why, as with bankruptcy, debt settlement is an extreme option, one you shouldn't take lightly. It's not just an easy, cheap way to eliminate debt.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.