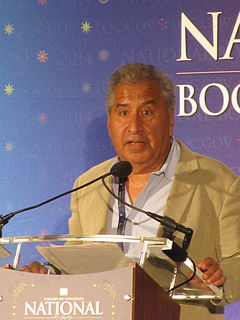

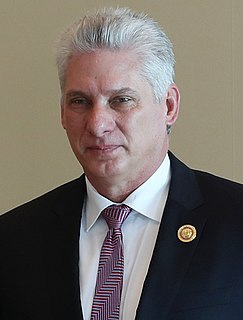

A Quote by Enrique Pena Nieto

Each dollar Mexico exports to the U.S. has a content of American production of 40.

Related Quotes

Weaker currencies abroad mean a strong dollar, and a stronger dollar, together with a weak global environment, is a drag on the U.S. economy. So it's important, as it affects overall levels of production and employment in the U.S. There are many domestic industries doing well in the United States, notwithstanding a strong dollar.

Venezuela is independent. It's diversifying its exports to a limited extent, instead of just being dependent on exports to the United States. And it's initiating moves toward Latin American integration and independence. It's what they call a Bolivarian alternative and the United States doesn't like any of that.

We believe that our truly urgent need is to make our nation secure, our economy strong and our dollar sound. For every American this matter of the sound dollar is crucial. Without a sound dollar, every American family would face a renewal of inflation, an ever-increasing cost of living, the withering away of savings and life insurance policies.

We need to realize that the economic situation between Mexico and the United States is not just one in which we trade with one another. We make things together. We have shared production platforms. Cross-border trade is part of a single production process, and while apparently the Trump administration will seek to re-examine elements of that production platform, it is what it is and won't be easily dismantled.