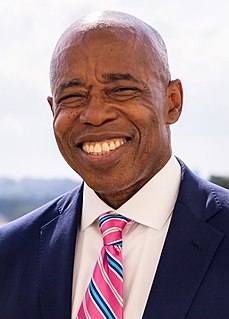

A Quote by Eric Adams

We can attract new businesses and jobs in fast-growing industries through tax incentives, incubators, zoning tools and CUNY partnerships.

Related Quotes

Urban America has been redlined. Government has not offered tax incentives for investment, as it has in a dozen foreign markets. Banks have redlined it. Industries have moved out, they've redlined it. Clearly, to break up the redlining process, there must be incentives to green-line with hedges against risk.