A Quote by Eric Alterman

Recently released government economic statistics covering 2010, the first year of real recovery from the financial collapse of 2008, found that fully 93 percent of additional income gains coming out of the recession went straight into the wallets and purses of the top 1 percent.

Related Quotes

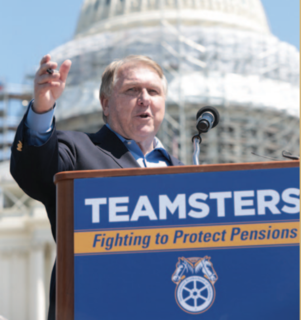

This is a very important issue that the corporate media chooses not to talk about a whole lot, that we have an economic system which is rigged, which means that at the same time as the middle class of this country is disappearing, almost all of the new income and wealth in America is going to the top 1 percent. You have the top one-tenth of 1 percent owning almost as much wealth as the bottom 90 percent - 58 percent of all new income is going to the top 1 percent.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

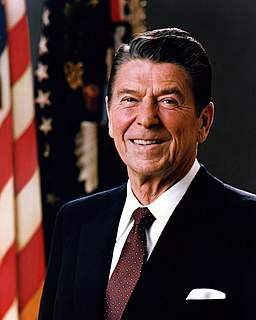

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

The Hispanic population grew by 4.7 percent last year, while blacks expanded by 1.5 percent and whites by a paltry 0.3 percent. Hispanics cast 6 percent of the vote in 1990 and 12 percent in 2000. If their numbers expand at the current pace, they will be up to 18 percent in 2010 and 24 percent in 2020. With one-third of Hispanics voting Republican, they are the jump ball in American politics. As this vote goes, so goes the future.

I know Teddy Kennedy had fun at the Democratic convention when he said that I said that trees and vegetation caused 80 percent of the air pollution in this country. ... Well, now he was a little wrong about what I said. I didn't say 80 percent. I said 92 percent-93 percent, pardon me. And I didn't say air pollution, I said oxides of nitrogen. Growing and decaying vegetation in this land are responsible for 93 percent of the oxides of nitrogen. ... If we are totally successful and can eliminate all the manmade oxides of nitrogen, we'll still have 93 percent as much as we have in the air today.

Most of the productivity gains appear to go to the top 1 percent. Most people don't have enough income and as a result, they borrow additional money by using their credit card and they fall into high debt. The result of the growing income gap is a slower growing GDP (too few people with money to spend) and a rising tide of indebtedness.