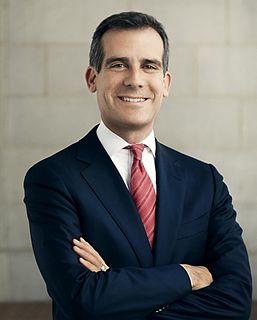

A Quote by Eric Garcetti

Aggressive government spending during the Great Recession was absolutely necessary.

Related Quotes

Do you know that all of the money that we are spending, that the government is spending, must come from you? The government has no great pile of gold to which it can go to get what it gives you. The government has not one cent that it does not take from your pockets. Do not imagine, do not believe, do not go on the theory that you are not to pay this bill, unless the fundamentals of our government are to be overturned.

An aggressive war is the great crime against everything good in the world. A defensive war, which must necessarily turn to aggressive at the earliest moment, is the necessary great counter-crime. But never think that war, no matter how necessary, nor how justified, is not a crime. Ask the infantry and ask the dead.

Obama has paid and will continue to pay dearly for betting on his stimulus package. Because of it, the Bush recession is becoming the Obama recession much faster than it would have had he adopted a more gradual approach to solving economic problems. By jumping in immediately, as he did, in order to increase government spending and pass eight years of Democratic dreams in one day, he made the public expect a solution.

Conservatives and liberals are kindred spirits as far as government spending is concerned. First, let's make sure we understand what government spending is. Since government has no resources of its own, and since there's no Tooth Fairy handing Congress the funds for the programs it enacts, we are forced to recognize that government spending is no less than the confiscation of one person's property to give it to another to whom it does not belong - in effect, legalized theft.

There are times when a market such as housing, transportation or the stock or mortgage market keep rising and people with capital want to join in this growth. Soon the markets become overheated, partly because of the abundance of investment money and speculation. This is when the government should raise interest rates and increase the cost of borrowed money. Governments are shy about doing this because it could cause the very recession. Yet this is the best time to do this so that the inevitable recession never reaches the magnitude of the recent Great Recession.

If the U.S. Government was a company, the deficit would be $5 trillion because they would have to account by general accepted accounting principles. But actually they encourage government spending, reckless government spending, because the government can issue Treasury bills at extremely low interest rates.

Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.

If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary. In framing a government which is to be administered by men over men, the great difficulty lies in this: you must first enable the government to control the governed; and in the next place oblige it to control itself. A dependence on the people is, no doubt, the primary control on the government; but experience has taught mankind the necessity of auxiliary precautions.

The Declaration [of Independence] was not a protest against government, but against the excess of government. It prescribed the proper role of government, to secure the rights of individuals and to effect their safety and happiness. In modern society, no individual can do this alone. So government is not a necessary evil but a necessary good.