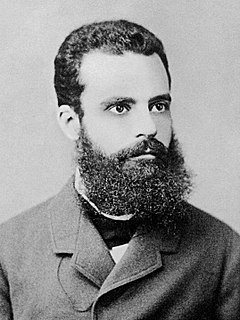

A Quote by Erik Prince

I live in Loudoun County, and the counties surrounding Washington, D.C., have the highest per-capita income in the country. Not because they create wealth, but because they suck wealth from the rest of the country, and that system needs to be shaken up.

Related Quotes

The counties with the highest per capita income aren't near New York City or Los Angeles - they're in the Washington, D.C. area - a one-company town where the company is the government. The three counties with the highest incomes in the entire country are all suburbs of Washington. Eleven of the 25 counties with the highest incomes are near Washington.

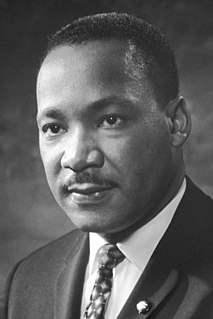

This is a very important issue that the corporate media chooses not to talk about a whole lot, that we have an economic system which is rigged, which means that at the same time as the middle class of this country is disappearing, almost all of the new income and wealth in America is going to the top 1 percent. You have the top one-tenth of 1 percent owning almost as much wealth as the bottom 90 percent - 58 percent of all new income is going to the top 1 percent.

They talk about class warfare -- the fact of the matter is there has been class warfare for the last thirty years. It's a handful of billionaires taking on the entire middle-class and working-class of this country. And the result is you now have in America the most unequal distribution of wealth and income of any major country on Earth and the worst inequality in America since 1928. How could anybody defend the top 400 richest people in this country owning more wealth than the bottom half of America, 150 million people?

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.