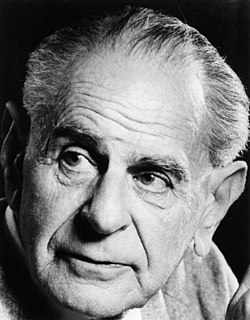

A Quote by Eugene Fama

There's quite a bit of evidence that even professionals don't show any ability to pick stocks or to predict market rollbacks. Most of the people we identify as skilled based on returns have probably just been lucky.

Related Quotes

I have been villainized because of my identity - I've received nasty blog comments and emails just based on my willingness to identify with feminism by people who clearly don't understand what I value and why I identify as a feminist. Ultimately, I'm less concerned with whether or not people identify as feminist and am more concerned with whether or not people understand what feminism is. If they don't want to identify as a feminist that's fine. I respect people's decision to identify any way they want and expect that same respect in return, although I don't always get it.

People who keep a large snake in their apartment building, which happens quite a bit, all of a sudden, within two summers, have a 14-foot animal that's eating adult rabbits, and needs quite a bit of room and quite a bit of heat. That's the animal that gets put in the back of a pick-up truck and dumped into the Florida Everglades or the city lake, or just left on a doorstep - again, it's quite often the animal that suffers.

Markets are efficient, but there are different dimensions of risk and those lead to different dimensions of expected returns. That's what people should be concerned with in their investment decisions and not with whether they can pick stocks, pick winners and losers among the various managers delivering basically the same product.

If you can predict where the market's going, just do what you can predict. If you can't, which is the presumption of dollar cost averaging or time cost averaging, either one, then you're trying to ease in. But if the market rises more than it falls most of the time, easing in is, by definition, a loser's game.

Astrologers were greatly impressed, and misled, by what they believed to be confirming evidence-so much so that they were quite unimpressed by any unfavorable evidence. Moreover, by making their interpretations and prophecies sufficiently vague they were able to explain away anything that might have been a refutation of the theory had the theory and the prophecies been more precise. In order to escape falsification they destroyed the testability of their theory. It is a typical soothsayer's trick to predict things so vaguely that the predictions can hardly fail: that they become irrefutable.

Skilled shortages in America exist because we are shielding our skilled labor force from world competition. [Visa quotas] have been substituted for the wage pricing mechanism. In the process we have created [a] privileged elite whose incomes are being supported at non-competitively high levels by immigration quotas on skilled professionals. Eliminating such restrictions would reduce at least some of the income inequality.