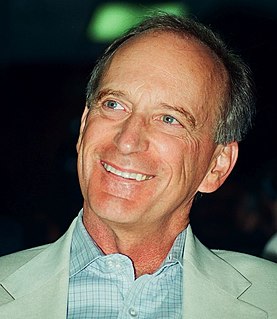

A Quote by Eugene Fama

The proposition is that prices reflect all available information, which in simple terms means since prices reflect all available information, there's no way to beat the market.

Related Quotes

I believe in market economics. But to paraphrase Churchill - who said this about democracy and political regimes - a market economy might be the worst economic regime available, apart from the alternatives. I believe that people react to incentives, that incentives matter, and that prices reflect the way things should be allocated. But I also believe that market economies sometimes have market failures, and when these occur, there's a role for prudential - not excessive - regulation of the financial system.

Money and prices and markets don't give us exact information about how much our suburbs, freeways, and spandex cost. Instead, everything else is giving us accurate information: our beleaguered air and watersheds, our overworked soils, our decimated inner cities. All of these provide information our prices should be giving us but do not.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.