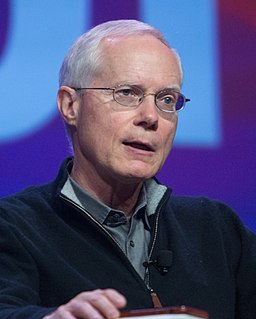

A Quote by Eugene Scalia

ESG investing poses particular concerns under the Employee Retirement Income Security Act, or Erisa, the federal law governing private retirement plans.

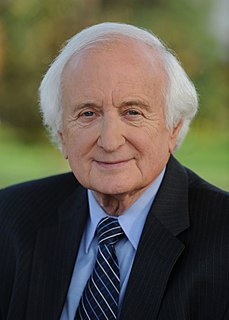

Related Quotes

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

At the heart of Erisa is the requirement that plan fiduciaries act with an 'eye single' to funding the retirements of plan participants and beneficiaries. This means investment decisions must be based solely on whether they enhance retirement savings, regardless of the fiduciary's personal preferences.