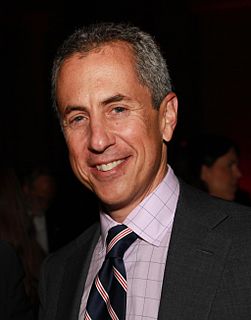

A Quote by Fabrizio Moreira

Investing in gold is one of the wisest decisions that you can make as an investor.

Related Quotes

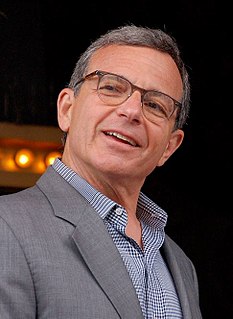

The part of capitalism that doesn't work for me is when capitalists make decisions in the way that Adam Smith suggested, which is that as long as you do everything in the interest of the investor, you're going to actually make the best decisions for all other stakeholders. I don't happen to agree with that.

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.