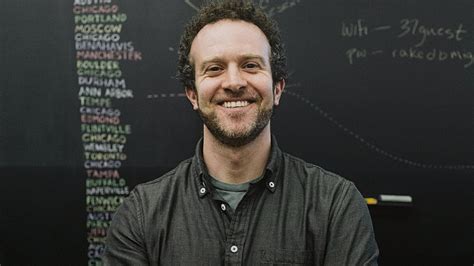

A Quote by Faith Popcorn

Make your company stock a consumer product. When consumers buy stock in your company, they'll never buy a competitive product. You've linked their financial future to yours.

Related Quotes

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

Since your company is the product that makes all of your other products, it should be the best product of all. When you begin to think of your company this way, you evaluate it differently. You ask different questions about it. You look at improving it constantly, rather than just accepting what it's become.

Instead of creating aesthetically pleasing prose, you have to dig into a product or service, uncover the reasons why consumers would want to buy the product, and present those sales arguments in copy that is read, understood, and reacted to—copy that makes the arguments so convincingly the customer can’t help but want to buy the product being advertised.

There are two kinds of people... There are the dreamers who go and buy, and there are the doers who go and make. And I've always recognized that. So the dreamers are what support our company because they will buy the product that they could make if they wanted to, had time to, or were so inclined to.