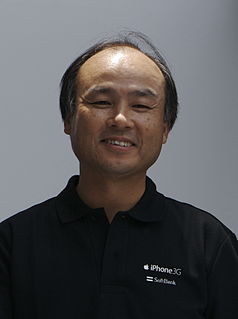

A Quote by Fareed Zakaria

There is very strong historical data that suggest the way societies grow is by making large, long-term investments.

Quote Topics

Related Quotes

I mean, these good folks are revolutionizing how businesses conduct their business. And, like them, I am very optimistic about our position in the world and about its influence on the United States. We're concerned about the short-term economic news, but long-term I'm optimistic. And so, I hope investors, you know - secondly, I hope investors hold investments for periods of time - that I've always found the best investments are those that you salt away based on economics.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.