A Quote by Francis Bacon

Fortune is like the market, where, many times, if you can stay a little, the price will fall.

Related Quotes

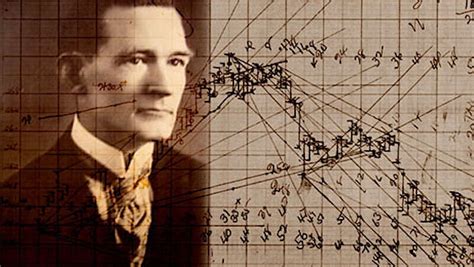

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

Just remember, without discipline, a clear strategy, and a concise plan, the speculator will fall into all the emotional pitfalls of the market - jump from one stock to another, hold a losing position too long, and cut out of a winner too soon, for no reason other than fear of losing profit. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator. Then, after a few failures and catastrophes the speculator may become demoralised, depressed, despondent, and abandon the market and the chance to make a fortune from what the market has to offer.

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.

If you increase the number of rockets you build and you buy, then it's the scale of the economy, the price is going to come down. It may not come down in order of magnitude, but if several commercial ventures start being successful and there becomes a bigger market for these rockets, the price will naturally come down a bit. That's why I think Excalibur Almaz, we're a little bit unique in that we don't look at our so-called competition with disdain, we want them to succeed and it needs to have more than one player. Even if we are successful, we couldn't handle the entire market ourselves.

Ridiculous as our market volatility might seem to an intelligent Martian, it is our reality and everyone loves to trot out the 'quote' attributed to Keynes (but never documented): 'The market can stay irrational longer than the investor can stay solvent.' For us agents, he might better have said 'The market can stay irrational longer than the client can stay patient.'