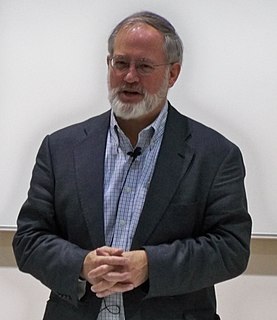

A Quote by Franklin Raines

We think if the economy remains weak that we could see mortgage rates trail down and we think that we could see rates below seven percent into early next year.

Related Quotes

Mortgage is one of the most popular deductions. It costs the Treasury about $103 billion a year. Now that's money we could use to treat wounded veterans or reduce the deficit or fill the border. Instead, we give it a subsidy to homeowners, and it goes mainly to the richest homeowners in America, because only one third of Americans itemize their deductions. It doesn't work. Many countries have gotten rid of the mortgage interest deduction. Almost all of them have higher homeownership rates than we do.

If you bring [tax] rates down, it makes it easier for small business to keep more of their capital and hire people. And for me, this is about jobs. I want to get America's economy going again. Fifty-four percent of America's workers work in businesses that are taxed as individuals. So when you bring those rates down, those small businesses are able to keep more money and hire more people.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

The black unemployment rate has to be twice that of the white rate in the US. If the national unemployment rate were 6.8 percent, everyone would be freaking out. We ought to not take too much solace in the 6.8 percent, but ask ourselves what can we do to bring that down to white rates, which are below 4 percent now. Some of that has to do with education, but that's just part of the story. You find that those unemployment differentials persist across every education level. I think it means pushing back on discrimination and helping people who can't find work get into the job market.