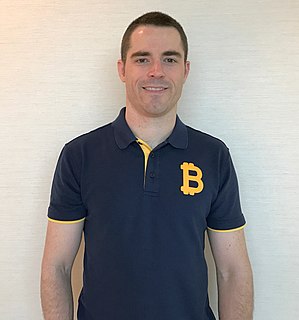

A Quote by Fred Ehrsam

The ability to easily buy and sell Bitcoin has been a really key factor in accelerating Bitcoin adoption.

Related Quotes

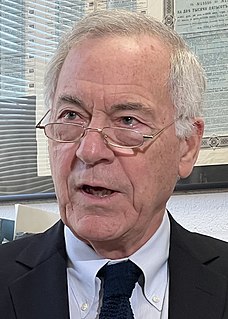

Well, bitcoin is a currency. Bitcoin has no underlying rate of return. You know, bonds have an interest coupon. Stocks have earnings and dividends. Gold has nothing, and bitcoin has nothing. There is nothing to support the bitcoin except the hope that you will sell it to somebody for more than you paid for it.