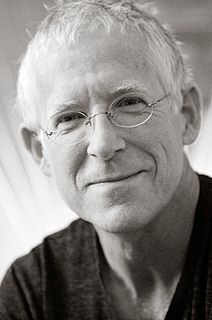

A Quote by Garrison Keillor

Where I'm from we don't trust paper. Wealth is what's here on the premises. If I open a cupboard and see, say, thirty cans of tomato sauce and a five-pound bag of rice, I get a little thrill of well-being - much more so than if I take a look at the quarterly dividend report from my mutual fund.

Related Quotes

One isn't born with courage. One develops it by doing small courageous things-in the way that if one sets out to pick up a 100-pound bag of rice, one would be advised to start with a five-pound bag, then 10 pounds, then 20 pounds, and so forth, until one builds up enough muscle to lift the 100-pound bag. It's the same way with courage. You do small courageous things that require some mental and spiritual exertion.

When you can sit down with a plain sheet of paper in front of you and make some notes, and, little by little, you see it take shape and become a concept for a movie or a TV show. That's a real thrill. You watch it go from notes on a paper to a meeting with writers and directors and actors. I can't think of anything that's more exciting.

The average person can’t really trust anybody. They can’t trust a broker, because the broker is interested in churning commissions. They can’t trust a mutual fund, because the mutual fund is interested in gathering a lot of assets and keeping them. And now it’s even worse because even the most sophisticated people have no idea what’s going on.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

When you open up the court, now the point guards can see, they can score, and they're not afraid to take shots. Before it was like, 'No, don't take that shot. That's a bad shot. Pound it inside. Pound it inside.' And the philosophy has gone a little bit away from that, because it makes sense to do it the other way.

I believe Washington should be a more active participant focusing on the issue of why corporate shareholders and mutual fund shareholders are not given fair treatment by corporate management and mutual fund management. We need to develop a national standard of fiduciary duty to ensure that these agents, if you will, are adequately representing the principles - pension beneficiaries and mutual fund shareholders - whom they are duty bound to serve.

I would say my being disheartened has more to do with American culture than anything else. We are becoming a very shallow culture. My goodness, the celebrity ethos has taken over completely. Turn on the television and you see that over and over. There's very little substance. And so, everything gets shorter. Everything is entertainment oriented. Our churches reflect that. A thirty-five minute sermon without a Power Point or video clips is rare these days. That's not true in other countries so much.