A Quote by Gary Becker

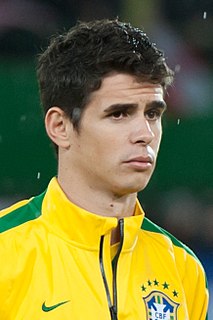

A stronger yuan could lead to greater Chinese asset accumulation in the U.S. and elsewhere.

Related Quotes

Our responsibility is to rally and lead the whole party and the Chinese people of all ethnic groups, take up this historic baton and continue working hard for the great renewal of the Chinese nation, so that we will stand rock firm in the family of nations and make fresh and greater contribution to mankind.

China got the local currency, the yuan which is appreciating against the dollar which means that all these Chinese people have more purchasing power. And they're willing now to spend some money after saving, you know they provided America with savings for years. Now they're going to spend some money. So this means that they are willing to allow the dollar to weaken because it means that their currency, the yuan goes up, so they're actually in a winning situation.

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

Communism seemed to be an ideal experiment in trying to achieve a state where all persons have greater democracy. I might add, like other persons here and elsewhere, I found myself concerned with the problem of increasing need for greater economic and political democracy for greater numbers of people.