A Quote by Gary Johnson

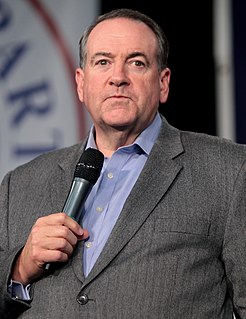

I think a great starting point for a debate and discussion over a national consumption tax is, let's start with the Fair Tax, legislation that has been written up and, I think, signed up on by 80 congressmen and women.

Related Quotes

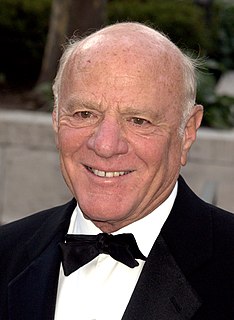

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

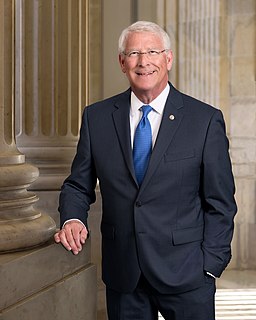

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

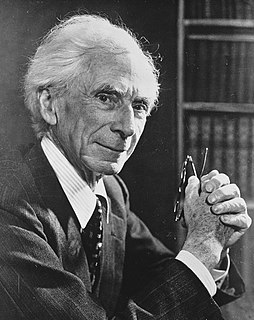

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

I don't think this is a situation where you can say that Congress was avoiding any mention of the tax power. It'd be one thing if Congress explicitly disavowed an exercise of the tax power. But given that it hasn't done so, it seems to me that it's - not only is it fair to read this as an exercise of the tax power, but this court has got an obligation to construe it as an exercise of the tax power if it can be upheld on that basis.