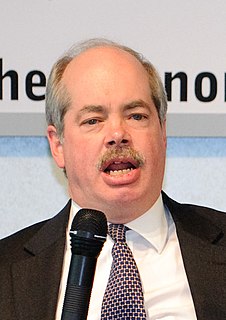

A Quote by Gary Miller

A variety of factors contribute to the price of gasoline in the United States. These factors include worldwide supply, demand and competition for crude oil, taxes, regional differences in access to gasoline supplies and environmental regulations.

Related Quotes

Renewable biofuels are meanwhile making inroads in the transportation fuels market and are beginning to have a measurable impact on demand for petroleum fuels, contributing to a decline in oil consumption in the United States in particular starting in 2006... The 93 billion liters of biofuels produced worldwide in 2009 displaced the equivalent of an estimated 68 billion liters of gasoline, equal to about 5 percent of world gasoline production.

I do believe that oil production globally has peaked at 85 million barrels. And I've been very vocal about it. And what happens? The demand continues to rise. The only way you can possibly kill demand is with price. So the price of oil, gasoline, has to go up to kill the demand. Otherwise, keep the price down, the demand rises.

We passed law that encouraged consumption through different purchasing habits like, you know, hybrid vehicles. You buy hybrid, you get a tax credit. We've encouraged the spread of ethanol as an alternative to crude oil. We have asked for Congress to pass regulatory relief so we can build more refineries to increase the supply of gasoline, hopefully taking the pressure off of price. And so the strategy is to recognize that dependency upon crude oil, in a global market, affects us economically here at home. And, therefore, we need to diversify away as quickly as possible.

The drilling idea is spherically senseless - it's senseless from whatever point of view you look at it. It'd take 10 years to bring any oil online, and it would probably go to Japan. It sure wouldn't help gasoline prices here. All the economists say gasoline is still too cheap in the United States anyway. So here we're having this huge debate over offshore drilling that is just straightforward nonsense, which won't surprise you.

Say that Congress legislates gasoline price controls that sets a maximum price of $1 a gallon. As sure as night follows day, there'd be long lines and gasoline shortages, just as there were in the 1970s. For the average consumer, a $1.60 a gallon selling price and no waiting lines is a darn sight cheaper than a controlled $1 a gallon price plus searching for a gasoline station that has gas and then waiting in line. If your average purchase is 10 gallons, and if an hour or so of your time is worth more that $6, the $1.60 a gallon free market price is cheaper.

About 75% of the price of gas is really dictated by crude oil. At the heart of the issue is increasing demand over a period of many years around the world. World crude oil consumption now is close to 90 million barrels a day. Most of the growth in demand is coming from China and the developing world.