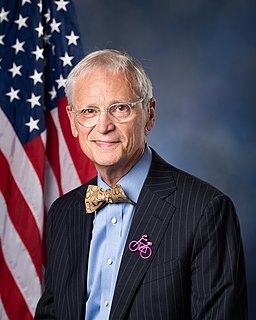

A Quote by Gary Miller

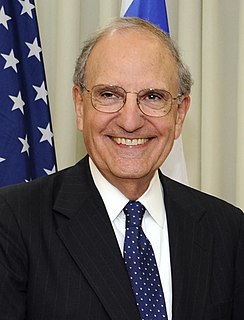

Today more than 20,000 communities participate in the National Flood Insurance Program. More than 90 insurance companies sell and service flood service insurance. There are more than four million policies covering the total of $800 billion.

Related Quotes

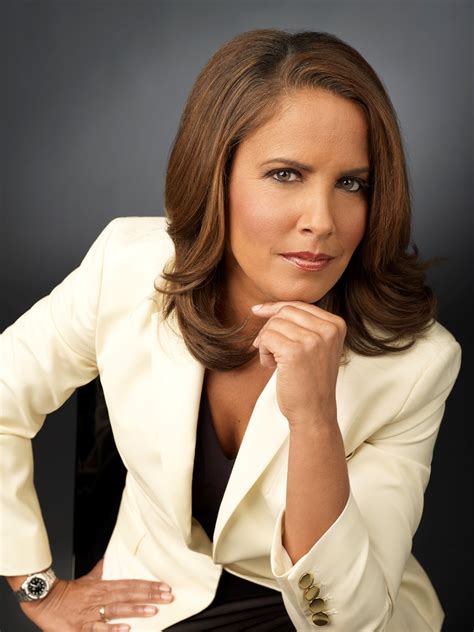

Health insurance, which is exceedingly difficult to secure as an individual in New York. Obamacare, while certainly better than nothing, is pretty awful, and if you have a complicated health history, as I do, you need premium insurance, which means private insurance. The challenge, though, is finding a company that will give you the privilege of paying up to $1,400 a month for it. When I didn't have a job, I spent more time thinking about insurance - not just paying for it, but securing it in the first place - than I wanted to.

The best tool today is longevity insurance - they call it income insurance. Most people know the value of life insurance. But what if you live? So instead of trying to guess one or the other, you plan for those 20 years and you get this income insurance. If you live beyond 85, you have money that's guaranteed for as long as you live in the form of an annuity.