A Quote by Gary Weiss

Short-sellers perform a useful function in the market as conduits of negative information, and shorts often complain that they are discriminated against by regulators.

Related Quotes

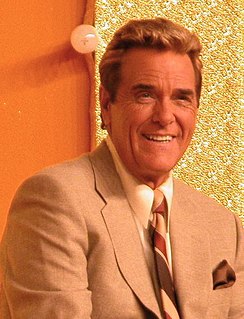

We were born with natural rights. We don't need civil rights. [African-Americans] don't need civil rights. They don't need them. They have inalienable rights granted by God in the Constitution. I mean, I'm discriminated against all the time. I don't care. It doesn't bother me. [I'm discriminated against] because I'm old. I'm too old to get a job as a game show host. They say, well, the guy's 71 and in five years he'll be 76. And I'm a one per center, and I'm absolutely discriminated against as a one per center.

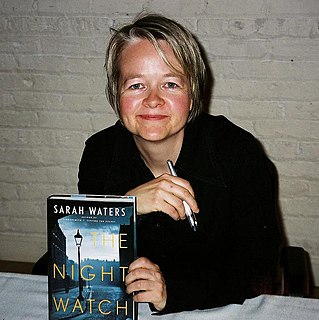

Kids coming from very difficult economic circumstances in urban areas are in some ways discriminated against in ways that are similar to the way people with intellectual disabilities are discriminated against. People are afraid of them. People sometimes assume that they don't have skills, gifts or abilities to contribute.

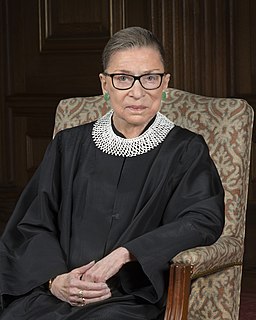

Those labeled felons may be denied the right to vote, are automatically excluded from juries, and may be legally discriminated against in employment, housing, access to education, public benefits, much like their grandparents or great grandparents may have been discriminated against during the Jim Crow era.

Allowing short selling is allowing people to sell - instead of having to buy the stock and then sell it, which doesn't do much; allow them to sell it, and then buy it. In which case they can express that information and the idea is that you would get more accurate valuation of companies by letting people express both their positive information and their negative information through either long or short selling.

People vastly overestimate the ability of central planners to improve on the independent action of diverse individuals. What I've learned watching regulators is that they almost always make things worse. If regulators did nothing, the self-correcting mechanisms of the market would mitigate most problems with more finesse. And less cost.