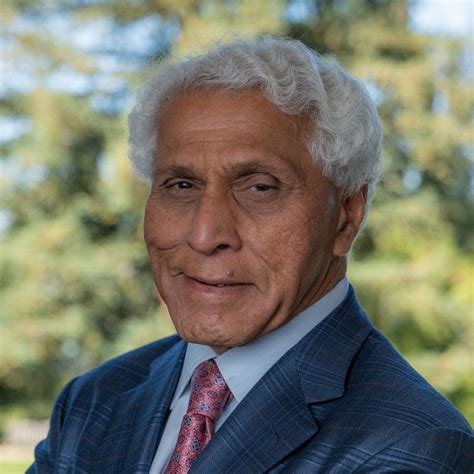

A Quote by Gavin Esler

I am the typical British aspiring working class. To be called 'elite' by people who have inherited wealth and run hedge funds or worked in the City of London, I don't criticise them for it, but the idea is frankly laughable. Just ridiculous.

Related Quotes

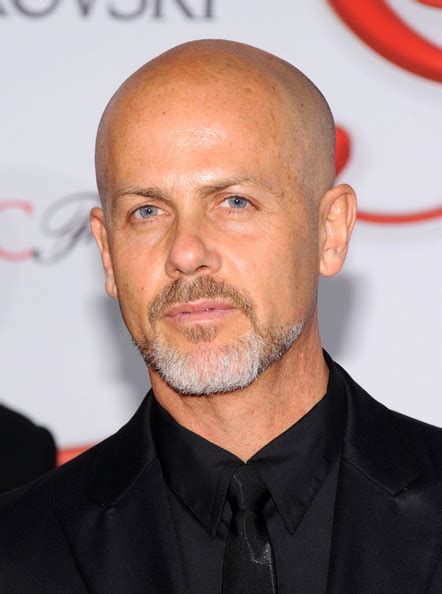

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

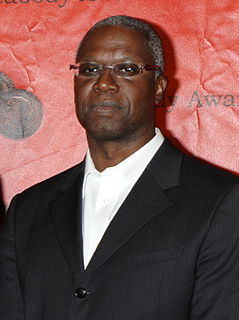

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

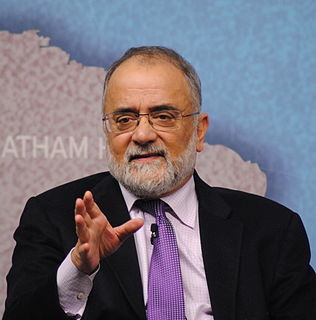

In the past, people couldn't place me. They thought that I was Danish or English or French. They never got that I am Italian. I'm not typical, maybe because my visual education was very mixed. There was a lot of London in my aesthetic: The Face, i-D, British music, and a lot of British fashion . . . But I really enjoy this contrast.

We are seeing more managed money and, to an extent, institutional money entering the space. Anecdotally speaking, I know of many people who are working at hedge funds or other investment managers who are trading cryptocurrency personally, the question is, when do people start doing it with their firms and funds?

I have to admit, I am aware of my Latin roots now. In the past, people couldn't place me. They thought that I was Danish or English or French. They never got that I am Italian. I'm not typical, maybe because my visual education was very mixed. There was a lot of London in my aesthetic: The Face, i-D, British music, and a lot of British fashion . . . But I really enjoy this contrast. I can go from Lady Gaga to Brian Eno in a split second.