A Quote by Gene Green

Shell and Exxon support export, but refiners like Valero could end up paying more for the crude oil.

Related Quotes

Ecologically speaking, a spilt tanker load is like sticking a safety pin into an elephant's foot. The planet barely notices. After the Exxon Valdez accident in Alaska the oil company spent billions tidying up the coastline, but it was a waste of money because the waves were cleaning up faster than Exxon could. Environmentalists can never accept the planet's ability to self-heal.

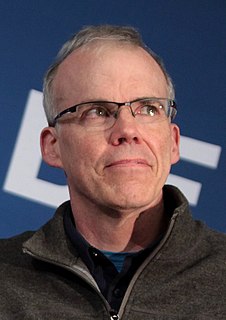

Scientists had said, "If you keep burning coal and gas and oil, you will melt the Arctic." And then the Arctic melted just as they had predicted. Did Shell Oil look at the melt and say, "Huh, maybe we should go into the solar-panel business instead?" No, Shell Oil looked at that and said, "Oh, well, now that it's melted it will be easier to drill for more oil up there." That's enough to make you doubt about the big brain being a good adaptation.

We passed law that encouraged consumption through different purchasing habits like, you know, hybrid vehicles. You buy hybrid, you get a tax credit. We've encouraged the spread of ethanol as an alternative to crude oil. We have asked for Congress to pass regulatory relief so we can build more refineries to increase the supply of gasoline, hopefully taking the pressure off of price. And so the strategy is to recognize that dependency upon crude oil, in a global market, affects us economically here at home. And, therefore, we need to diversify away as quickly as possible.

Some years ago one oil company bought a fertilizer company, and every other major oil company practically ran out and bought a fertilizer company. And there was no more damned reason for all these oil companies to buy fertilizer companies, but they didn't know exactly what to do, and if Exxon was doing it, it was good enough for Mobil and vice versa.

About 75% of the price of gas is really dictated by crude oil. At the heart of the issue is increasing demand over a period of many years around the world. World crude oil consumption now is close to 90 million barrels a day. Most of the growth in demand is coming from China and the developing world.

Bahrain lies at the epicenter of Gulf security and any violent upheaval in Bahrain would have enormous geopolitical consequences. Global economic stability depends on the uninterrupted export of crude oil from the Gulf to markets around the world - a job that historically has been assigned to the U.S. Fifth Fleet.

There are signs that the age of petroleum has passed its zenith. Adjusted for inflation, a barrel of crude oil now sells for three times its long-run average. The large western oil companies, which cartellised the industry for much of the 20th century, are now selling more oil than they find, and are thus in the throes of liquidation.