A Quote by George Gilder

From the equilibrium and spontaneous order of Adam Smith and his heirs, from invisible-handed markets and perfect competition, supply and demand, and rewards and punishments, I was pushed to theories of disequilibrium and disorder, and information and noise, as the keys to understanding economic progress.

Related Quotes

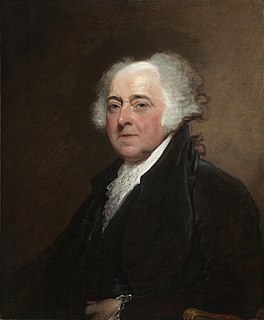

The good of the governed is the end, and rewards and punishments are the means, of all government. The government of the supreme and all-perfect Mind, over all his intellectual creation, is by proportioning rewards to piety and virtue, and punishments to disobedience and vice. ... The joys of heaven are prepared, and the horrors of hell in a future state, to render the moral government of the universe perfect and complete. Human government is more or less perfect, as it approaches nearer or diverges further from an imitation of this perfect plan of divine and moral government.

There are all sorts of institutions in the economic world which depart from the simple price/market model which I worked on in an earlier incarnation and which has been sort of the mainstream of economic theories since Adam Smith and David Ricardo. There are all sorts of contractual relations between firms and individuals which do not conform to the simple price theory - profit-sharing schemes and so forth - and the explanation for these suddenly became clear. We now understand why these emerged and that they are based on differences in information in the economy.