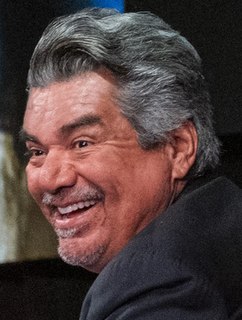

A Quote by George Lopez

As long as you're a tax deduction, you'll always be safe in my house.

Related Quotes

If you ask any economist, they'll tell you all the mortgage interest deduction does is raise the price of the house. So a couple is out looking at the house, they say, "Oh, we love this house, but we couldn't make the monthly payment." And the realtor says, "Yeah, but you're going to get a tax break." So people pay more than they would otherwise. You take a loss even though you're making a gain.

Even tax breaks that are supposed to help the middle class too often skew toward the wealthy. Consider the mortgage interest deduction. While political leaders in both parties have long considered it untouchable, it actually helps those at the top of the income scale far more than those at the bottom.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

There's a tradeoff. Yeah, I lose the deduction that I really like, but my tax rate is going to go down, and I don't have to fill out that form anymore. It's much simpler, rates are lower, and that tradeoff has worked in many countries. Many countries have just cleaned house of all those exemptions in order to provide lower rates, and people buy it.