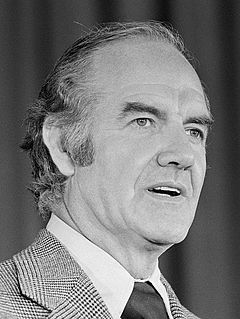

A Quote by George McGovern

And above all, above all, honest work must be rewarded by a fair and just tax system. The tax system today does not reward hard work: it penalizes it. Inherited or invested wealth frequently multiplies itself while paying no taxes at all. But wages on the assembly line or in farming the land, these hard-earned dollars are taxed to the very last penny.

Related Quotes

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.

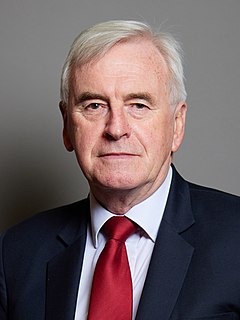

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

Land taxes is the thing. They got so high that there is no chance to make anything. Not only land but all property tax. You see in the old days, why the only thing they knew how to tax was land, or a house. Well, that condition went along for quite awhile, so even today the whole country tries to run its revenue on taxes on land. They never ask if the land makes anything. "It's land ain't it? Well tax it then."

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.