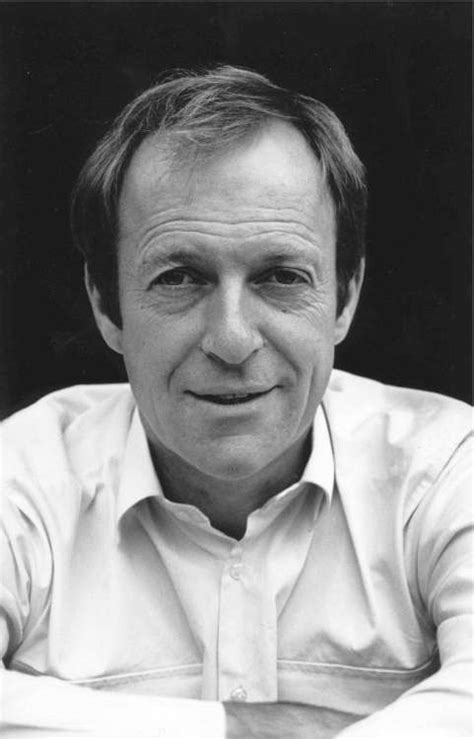

A Quote by George Osborne

The rise in world oil prices has been larger than anyone forecast.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

Satellite photography in the 1970's gave rise to the long-range weather forecast, a month at a time. This in turn gave rise to the observation that the long-range weather forecast was wrong most of the time. In turn, this gave rise to the dropping of the long-range weather forecast and to the admission that really accurate forecasting could only cover the next day or two, and not always then.

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

Russia does not have a modern economy: it's a petro-power. The only thing it sells that the world wants to buy is oil and natural gas. When was the last time anyone bought a Russian computer? A Russian car? A Russian cell phone? Russia is so dependent on high energy prices that if oil falls below $100 a barrel, the Kremlin can't meet payroll.

Even if we were to sign peace today, the economic conditions in our country would not improve automatically because it will take some time to reach the level of oil production before the war and the oil prices are likely to remain low for some time as the supply of oil in the world is high and demand is low.