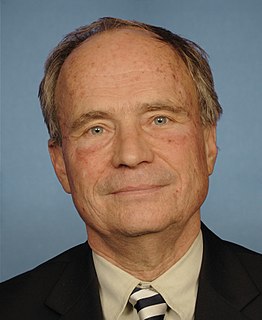

A Quote by George Soros

By creating the European Central Bank, the member states exposed their own government bonds to the risk of default. Developed countries that issue bonds in their own currency never default, because they can always print money. Their currency may depreciate, but the risk of default is absent.

Related Quotes

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.

This is the joint responsibility of everyone who was involved in the introduction of the euro without understanding the consequences. When the euro was introduced, the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital. And the European Central Bank discounted all government bonds on equal terms. So commercial banks found it advantageous to accumulate the bonds of the weaker countries to earn a few extra basis points.

It is absurd to say that our country can issue $30,000,000 in bonds and not $30,000,000 in currency. Both are promises to pay; but one promise fattens the usurer (banker), and the other helps the people. If the currency issued by the Government were no good, then the bonds issued would be no good either. It is a terrible situation when the Government, to increase the national wealth, must go into debt and submit to ruinous interest charges at the hands of men who control the fictitious values of gold.

I think the credit default swaps can take the place of the rating agencies who really have missed the ball in this procedure and are quite conflicted by the way the ratings are paid for. So, I would like to see credit default swaps become an evermore important way of understanding credit risk in the economy.