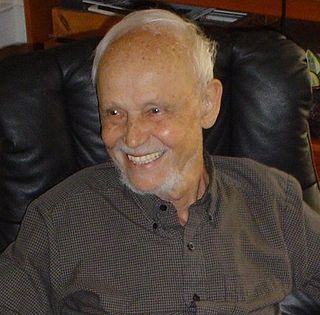

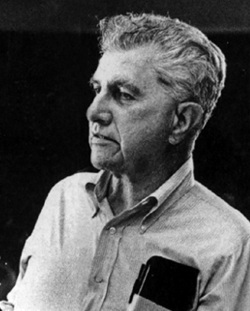

A Quote by George Soros

Taking this view, it is possible to see financial markets as a laboratory for testing hypotheses, albeit not strictly scientific ones. The truth is, successful investing is a kind of alchemy.

Related Quotes

Evidence-based reasoning underpins all scientific thinking, and it involves testing hypotheses or theories against data. Validating a theory requires replicable measurements from independent groups with different equipment and methods of analysis. Convergence of evidence is critical to the acceptance of a scientific idea.

The Lean Startup is a process for turning ideas into commercial ventures. Its premise is that startups begin with a series of untested hypotheses. They succeed by getting out of the building, testing those hypotheses and learning by iterating and refining minimal viable products in front of potential customers.

One of the greatest accomplishments of Western civilization is the development of the scientific method and the scientific disposition, which entail the development of falsifiable hypotheses about the world and the unwillingness to take unverified and untheorized claims about the world as truth, simply because someone states that they are true.

In Germany it is good if as many people as possible join initiatives and peaceful demonstrations against the rule of the financial markets. Worshipping the unfettered freedom of global markets has brought the world to the brink of ruin. We now need social and ecological rules for the market economy.